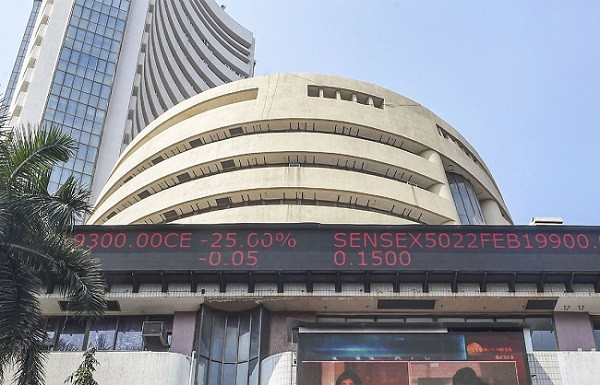

Sensex Rallies Strongly, Investor Sentiment Turns Positive Amid Market Recovery

IIE DIGITAL DESK :The Indian stock market witnessed a robust recovery on Friday as the Sensex surged, bringing much-needed relief to investors and signaling renewed confidence in the country’s economic outlook. The BSE Sensex closed over 600 points higher, marking one of its strongest performances in recent weeks, and reflecting a broader positive trend across major sectors.

The rally was fueled by gains in key sectors such as banking, IT, auto, and FMCG. Market analysts attribute the upward momentum to favorable global cues, stable domestic macroeconomic indicators, and improved foreign institutional investor (FII) activity. The easing of geopolitical tensions and a dip in crude oil prices also played a significant role in boosting investor sentiment.

Leading companies including Reliance Industries, HDFC Bank, TCS, and Infosys registered notable gains, contributing significantly to the Sensex’s upward movement. Midcap and smallcap stocks also followed suit, indicating a broad-based recovery and renewed retail investor interest.

Investor mood, which had been dampened in recent weeks due to global uncertainties and inflation concerns, showed marked improvement as the market regained traction. Trading volumes remained strong throughout the day, with experts suggesting that this momentum could continue in the short term if economic data remains supportive.

Market experts advise cautious optimism, emphasizing the importance of keeping a close watch on upcoming earnings reports, RBI policy updates, and global economic trends. However, the current upswing has certainly provided a psychological boost for both institutional and retail investors, many of whom are now rebalancing portfolios in light of the recent surge.

As the Sensex gains strength, market watchers believe this could be the start of a sustained recovery phase, especially if domestic and global factors align in favor of economic stability and growth.

You might also like!